Eligibility to avail EPS benefits. A Member can deter the pension up to 60 years without contribution Member may defer the pension up to 59 years or 60 years of age without contributionBenefit of increase in original peosion amount of 4 in case of one completed year and 816 in case of 2 completed years.

Epf Contribution At 11 Causes Confusion For Employers Here S A Quick Guide

Regards Shweta Singh 19th March 2011 From India Hyderabad MadhuTK 3742 3.

. In this scenario quantum of pension is increase by 4 per year beyond 58 years. 192014 or is it mandatory to pay the increased epf contribution for them since they are still continuing in service. More Jul 13 Shubham Sultania Yes please.

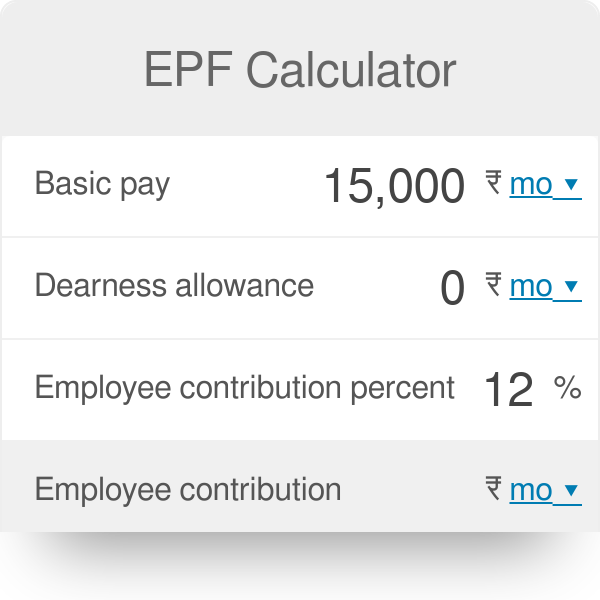

Employers and employees contribution rate for EPF as of the year 2021 Following the Budget 2021 announcement employees EPF contribution rate for all employees under 60 years old is reduced from 11 to 9 by default from February 2021 contribution to. Sun Mar 24 2019 Previous employers EPF contribution rate was 6 per month for employees aged 60 and above while employees were required to contribute 55. It is proposed to calculate pensionable salary on the basis of average of salary last 60 months instead of 12 months presently.

Yes they can deduct PF from employee even after 58 as long as the person is retained in service with normal pay. You can claim the pension after completing 58 years of age. Until you reach the age of 60 years you will be eligible to receive the pension at an additional rate of 4 per year.

You can withdraw all or part of the savings from this account at any time. Under PF Law there is no age of retirement. 2 Member can opt for receiving pension after attaining 59 or 60 years of age but pension contribution continues after 58 years.

While the employees entire part goes to EPF the employers contribution goes to EPS at a rate of 833 percent. UPTO 60 years. The new minimum rate would take effect with the January 2019 salarywage for contribution month of February 2019.

The pensionable salary is used for fixing pension of the EPFO subscribers after attaining the age of 58 years. Pensionable employees in government services. After the employee retires the plan provides a steady stream of income.

KUALA LUMPUR 7 January 2019. Should you choose to continue working after the age of 55 all further contributions you make will be credited in your Akaun Emas to be withdrawn only upon reaching age 60. As per paragraph 606 of EPF.

At 58 when you stop contribution to Pension. EPF announces that the minimum Employers share of EPF statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the Employees share of contribution rate will be zero per cent. Pension will be increased to 110 percent.

B Member can defer the pension up to 60 years with contribution s. The move to reduce the statutory contribution rates follows the governments proposal during the tabling of Budget 2019 to help increase the take-home pay of employees who continue to work after reaching age 60 it said. The employee can avail of the pension benefit after retirement or once he attains 58 years of his age.

Effective from 2019 the minimum employers contribution rate of EPF for employees aged 60 and above has been reduced to 4 per month. If an employee completes his or her 60 years then he or she cant be on payrollmeans there would not be any deduction like PF ESIThey can be work in the company on contract basis only for the contractual employeesthere is no any deduction like PF ESI. However at reaching the age 58 you have to stop the contribution towards Pension and contribute the entire amount of employer share in PF account.

Private industry super annuation age is 60 but many people are retained for further 3-5 years and they do contribute to PF. The minimum employers share of contribution rate has been set at 4 per month while the employees share of contribution rate will be 0. Besides other things the trustees will also consider the proposal for computing the pensionable salary.

That means you can deduct the PF till such time the employee is working for you even after the age 58 60. In such a scenario the quantum of pension shall.

Employee Provident Fund A Complete Guide

Epf Contribution At 11 Causes Confusion For Employers Here S A Quick Guide

In Plain English Epf For Malaysian Businesses The Vox Of Talenox

Epf Members Savings Worrying After Rm145b Withdrawals Says Mof The Edge Markets

Epf Contribution For Employee Age Above 60 Blog

Epf Contribution Reduced From 12 To 10 For Three Months

Epf Calculator Employees Provident Fund

Epf Contribution Rates 1952 2009 Download Table

Basics Of Employee Provident Fund Epf Eds Edlis Gst Guntur

Employee Provident Fund Epf Is Not Tax Free Anymore 60 Of Epf Withdrawals Will Be Taxed As Income Nri Sav Investment Tips Savings And Investment Tax Free

Eps Vs Nps Vs Apy Comparison How To Find Out Retirement Planning Retirement Benefits

Is There Any Restriction In Contribution To Epf For A Person Who Is In Full Time Employment Aged Above 60 The Economic Times

Epf Only 3 Of Contributors Can Afford Their Retirement Says Chief Strategy Officer The Star

Zero Epf Contribution For Above 60 Year Old Workers

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

How To Increase Epf Contributions For An Employee And Employer In Deskera People

Epfo Government Of India Will Pay The Epf Contribution Of Both Employer And Employee 12 Each For The Next Three Months So That Nobody Suffers Due To Loss Of Continuity In

Malaysia Keeps Epf Employee Contribution Rate Below 11 Pensions Investments